If you are still managing clients via heavy Excel spreadsheets, emails, and constant back-and-forth communication, you landed at the right place.

Get Free Consultancy

In the competitive landscape of the financial industry, the efficiency of client onboarding processes significantly impacts a company's operational efficacy, ability to scale, and, most importantly, client satisfaction. Traditional methods, burdened by cumbersome and error-prone manual tasks, lead to employee overload and compromise client experience. Such inefficiencies are particularly problematic because a streamlined onboarding process not only reduces manual effort but also enhances client engagement and directly influences trust, and builds rapport.

For instance, manual processing hampers the speed of account activations and leads to a consumption of valuable human resources, resulting in a delay that affects customer satisfaction and retention right from the start.

On average, manual data entry errors during the onboarding process led to significant delays in account activation for over 30% of the clients, directly impacting customer satisfaction and trust early in the relationship.

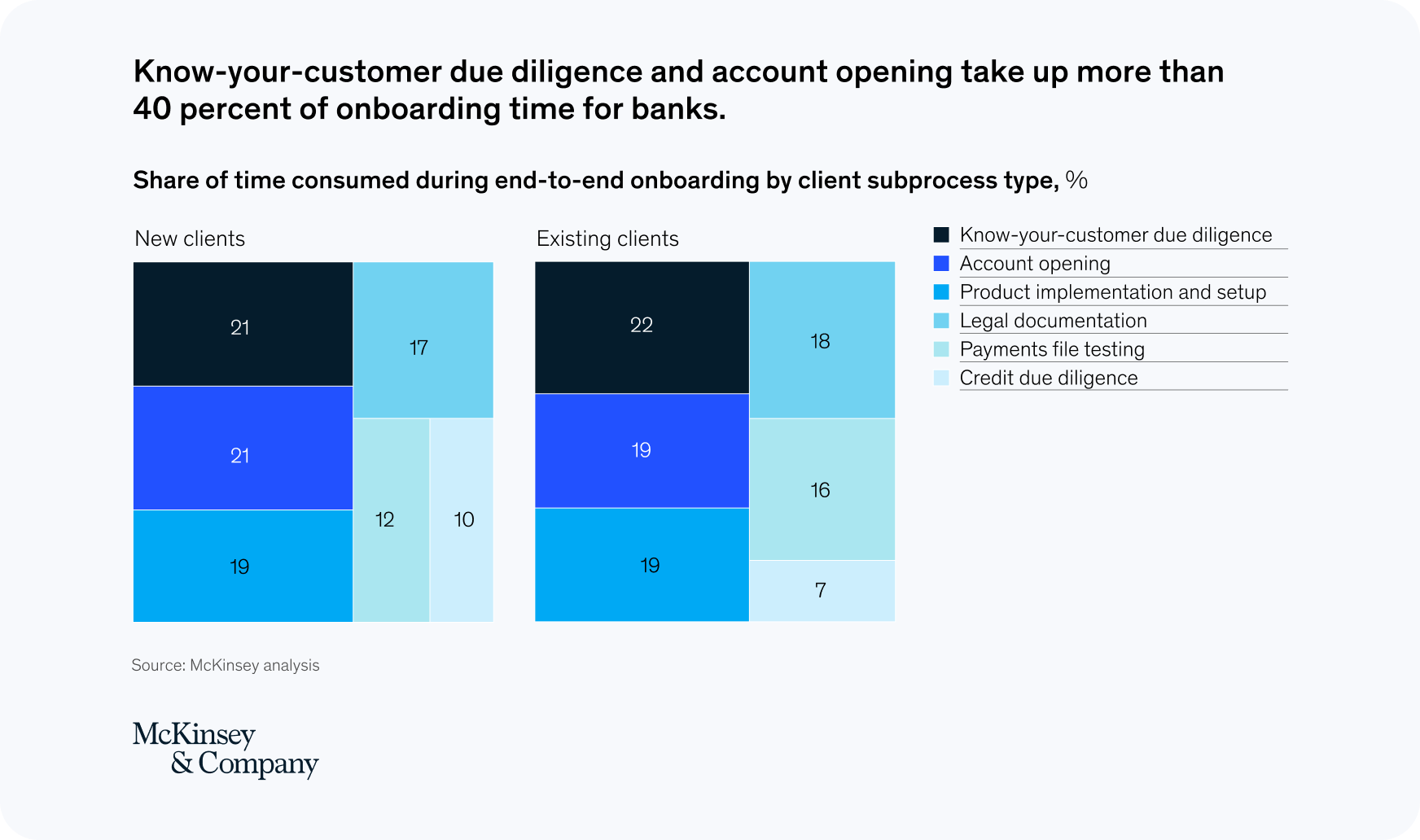

According to a McKinsey report, Know-your-customer (KYC) due diligence and account opening are significant bottlenecks. Banks report that more than 40% of the time a customer spends onboarding is consumed by these two processes.

This underscores the need to transform onboarding processes, enabling simultaneous client onboarding and enhancing client experiences, particularly in an era where efficiency translates directly to competitive advantage.

Imagine yourself as a client for a second. Your expectation would be typically outlined as quick and seamless onboarding without repetitive tasks or prolonged waiting periods. It is not uncommon for clients to seek transparency and responsiveness in the processes that govern their entry into new financial services. The inability of traditional methods to meet these expectations can lead to dissatisfaction and potential loss of clientele. Consider a scenario where a client submits information through a portal, or even worse – emails, only to be asked for the same information again during a follow-up meeting. Such redundancies lead to frustration, reflecting poorly on the company’s ability to manage data securely and effectively.

Typically, client onboarding involves collecting extensive information from the onset, validating the correctness of the data, detecting potential anomalies, and integrating them into the organization’s systems.

This process includes steps such as form submissions, reviews, and client data management, each prone to delays and errors due to their manual nature. Challenges arise in maintaining accuracy and speed, handling multiple clients simultaneously, and ensuring data reuse without redundancy. Multiply that by the potential resource-constrained nature of the business, and the chaos comes into play.

For instance, a financial advisor manually handling client portfolios might spend an average of six hours per client on data entry and form processing without even transitioning into data analysis—a significant drain on time and resources. The manual process always slows down operations but also introduces a higher likelihood of human error, affecting compliance and client trust.

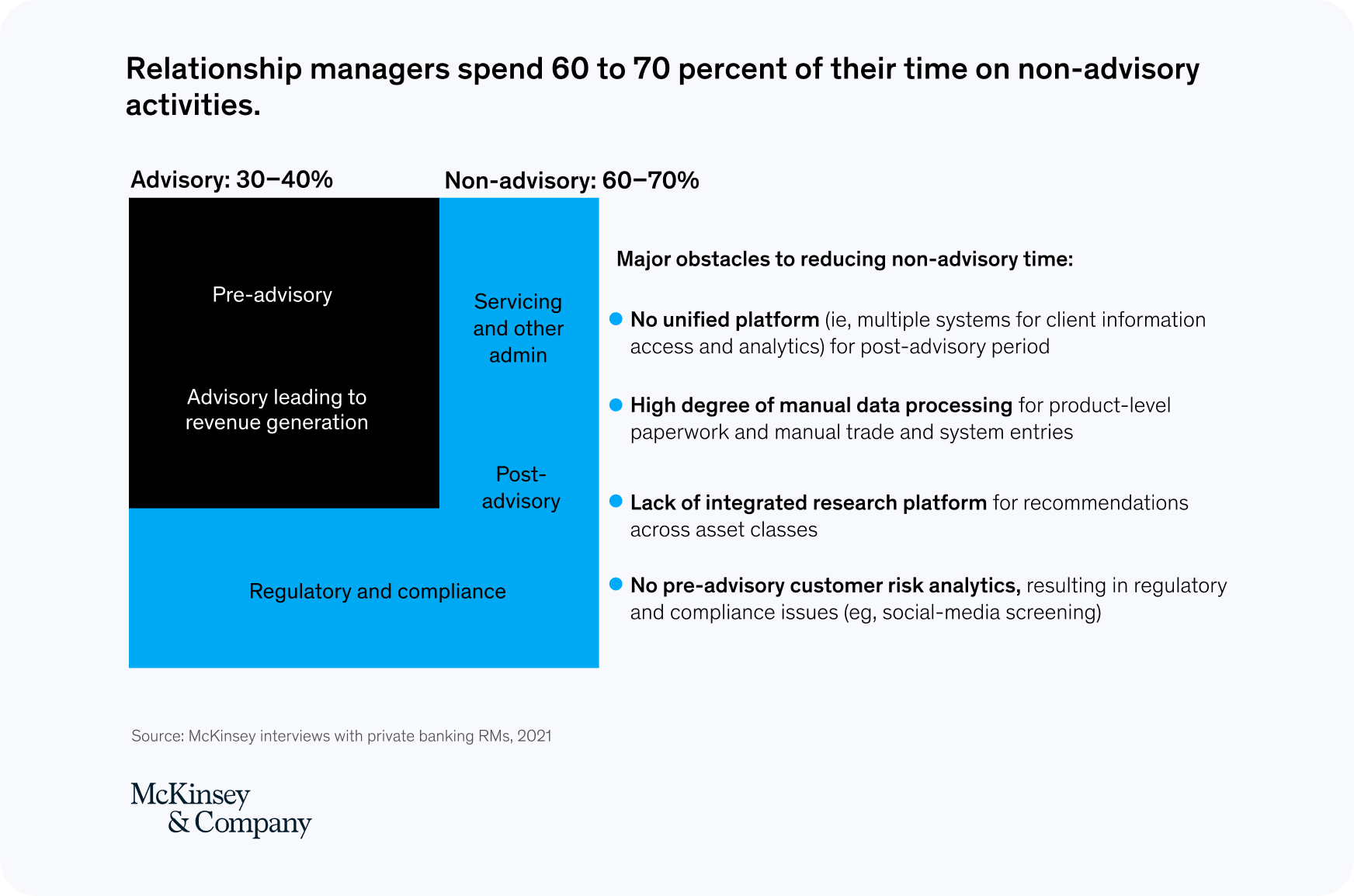

According to a McKinsey report, RMs typically spend 60 to 70 percent of their time on non-revenue-generating activities, amid rising regulatory and compliance obligations. One reason is that most still work with legacy IT systems or even spreadsheets. As clients demand more engagement and remote channel options, that needs to change.

The integration of Trisk’s AI-driven workflow automation into client onboarding processes fundamentally changes how financial advisors manage client intake, enabling simultaneous onboarding of multiple clients with minimal human intervention. This capability is crucial during periods when increasing headcount is impractical due to the challenges in attracting and training new talent. Utilization of Trisk allows to automate data verification and account setup processes, which leads to a significant increase in handling 50% more clients simultaneously without additional staff, reducing the time spent per client from several hours to mere minutes maximizes human resources allocation.

Access all-in-one features to facilitate quicker revenue realization from new clients

30-day free trial with no credit card required

Scalability: By reducing the reliance on manual processes, organizations can scale operations rapidly without proportional increases in headcount, an invaluable benefit in today's talent-constrained market.

Client Satisfaction and Retention: Fast, transparent, and error-free onboarding processes significantly enhance client satisfaction, fostering loyalty and reducing churn. Clients appreciate efficient service delivery, which, in turn, enhances their overall trust in the institution.

Increased Revenue Streams: Automated workflows facilitate quicker revenue realization from new clients and enhance the ability to cross-sell and upsell. For instance, conditional workflows can intelligently offer additional services like investment opportunities or premium accounts based on client data analyzed during the onboarding process.

Strategic Resource Allocation: Freed from routine tasks, staff can focus on higher-value activities, such as client relationship management and strategic initiatives, driving further business growth.

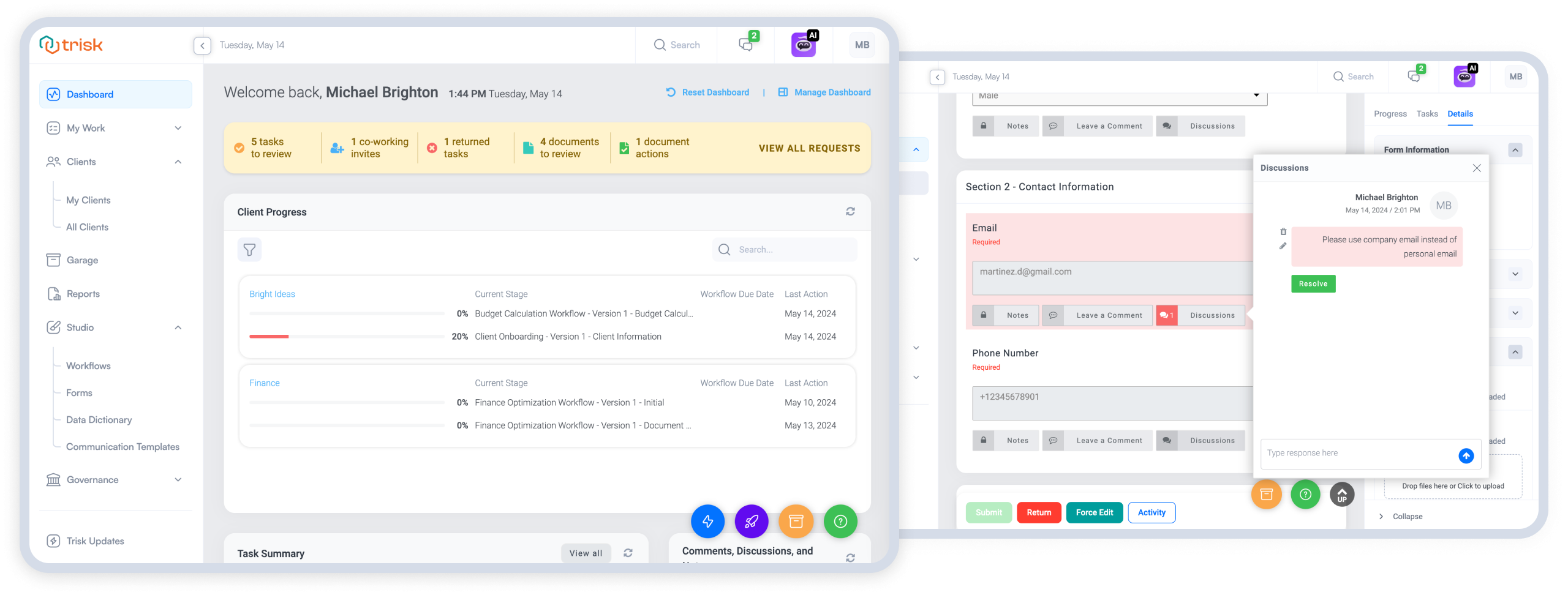

Trisk’s capability to manage complex workflows includes sophisticated data collection, analysis, document management, and granular access controls, ensuring each client interaction maximizes efficiency and compliance. Enhanced document management allows multiple stakeholders to review and comment simultaneously, reducing the cycle time for approvals and feedback and dramatically improving operational responsiveness.

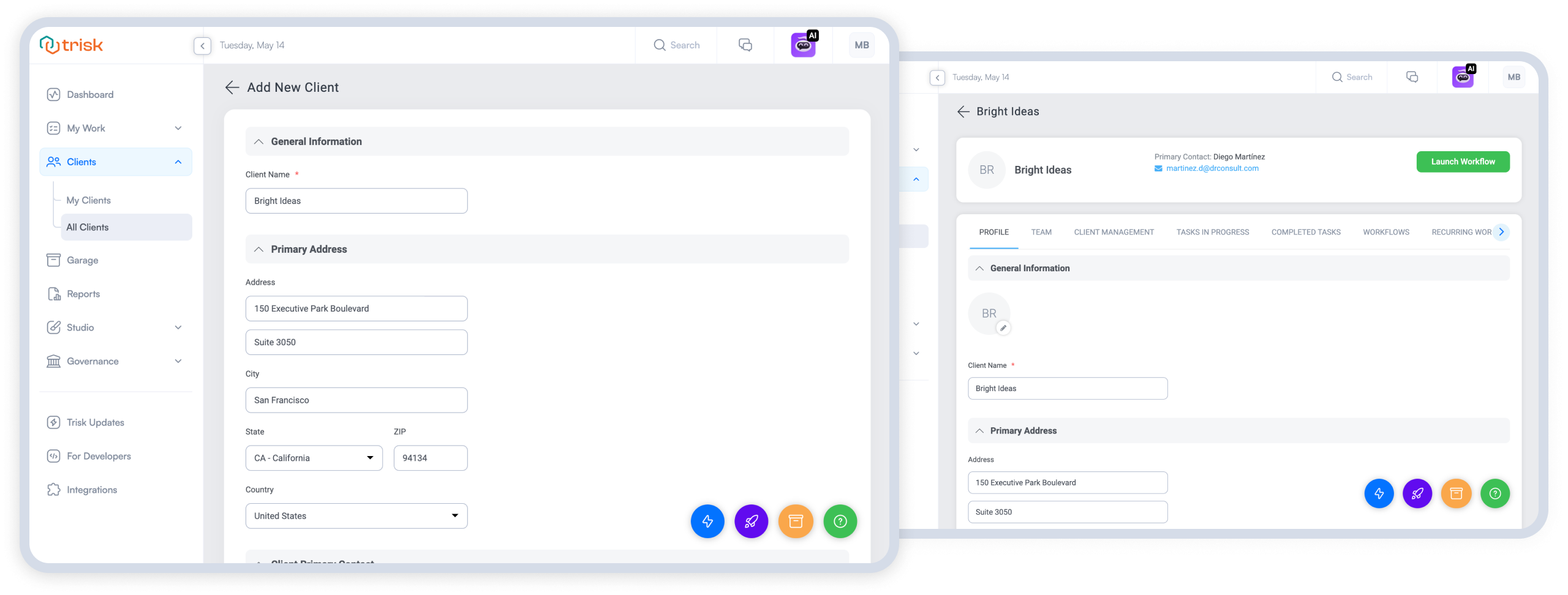

First and foremost, each client has a fully dedicated profile where they can manage (permissions-driven) their information, users, completed and opened workflows, access real-time data produced by the workflows, collaborate on the tasks, and gain complete transparency of the progress. Clients aren’t limited by the number of entities they can have on the platform and can even organize child entities or subsidiaries within the parent entity.

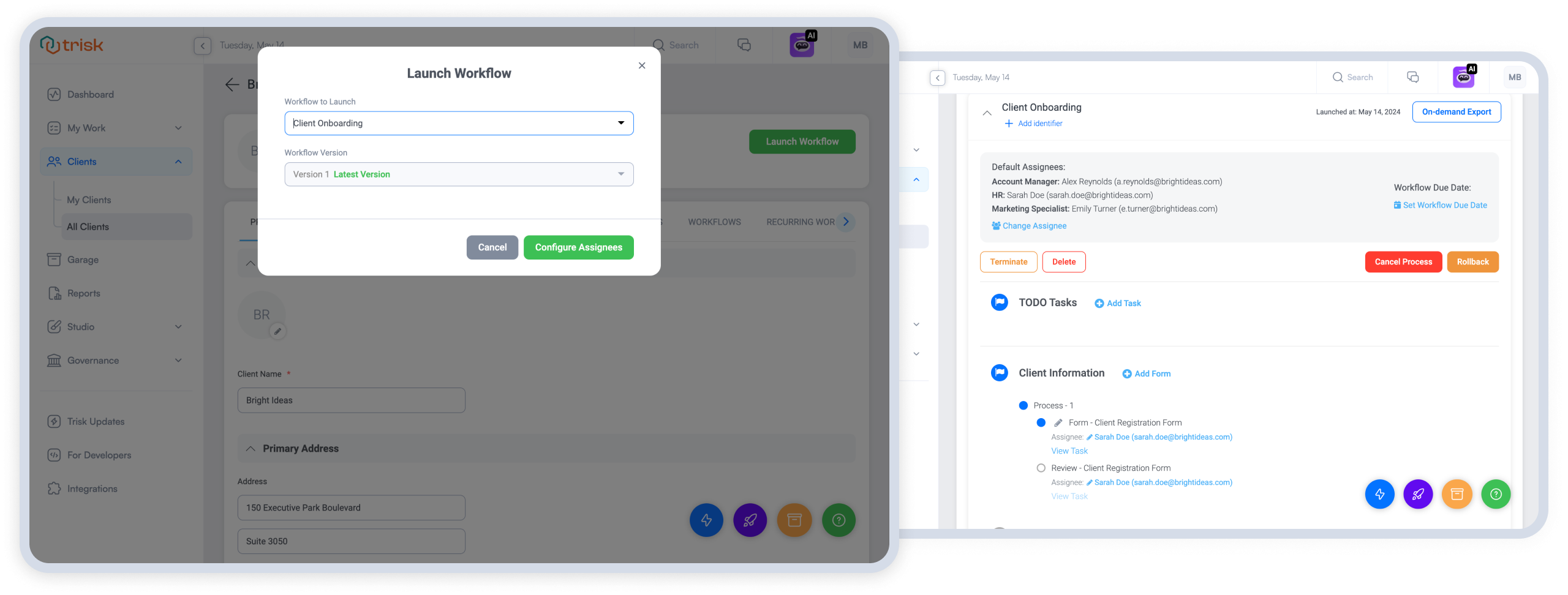

Once the client’s profile is created on the platform, the responsible person from the organization’s side can instantly launch an onboarding workflow or any additional workflows that are case-specific for the client or organization’s operations, and the rest will be handled by the automation: from assigning the right people to the specific activities on the project, and further to email communications, activity tracking, and due dates management along with reminders and past due notices.

Unlock tailored service offerings and hidden business opportunities.

Make a strategic decision to drive substantial revenue growth.

No upfront commitment

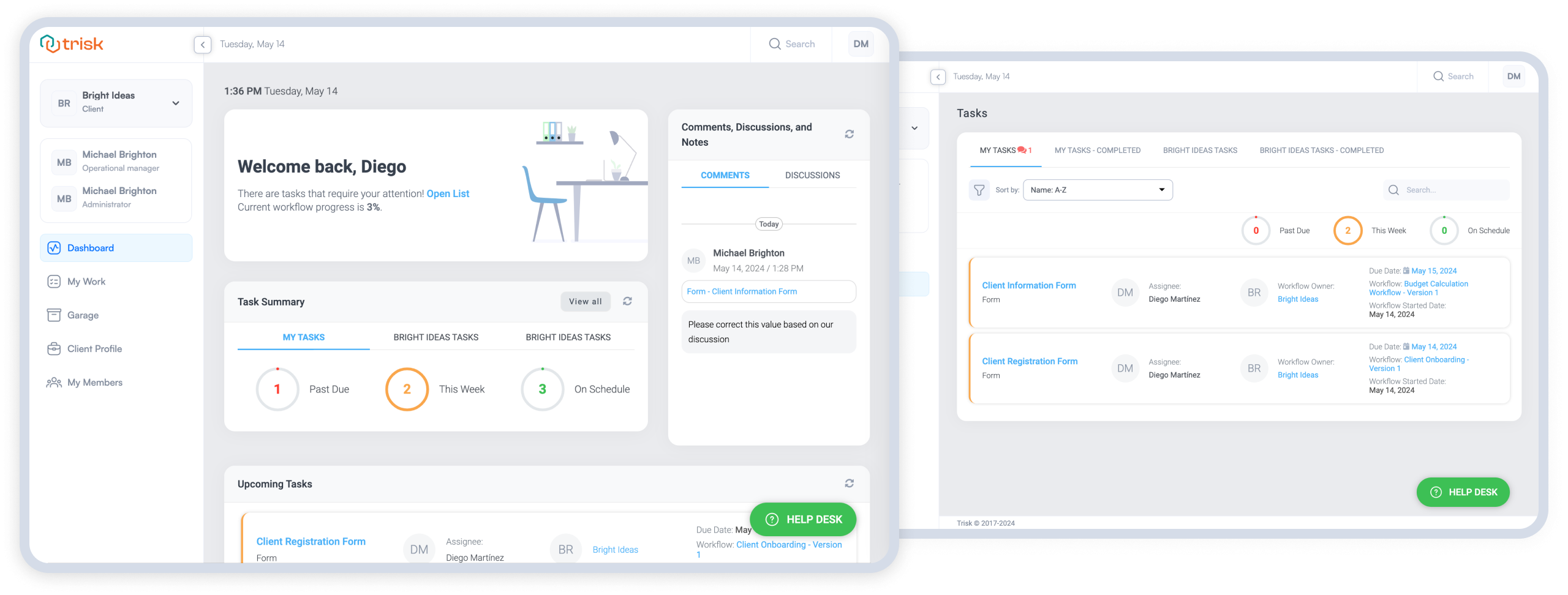

Client-responsible people receive a true self-service predefined set of tasks on their intuitive and clean dashboards, enabling them to easily advance the project forward. Forget about calling and texting people to find out if they received the email, or task, or even looked at it–Trisk automatically captures all the activities and keeps the team accountable.

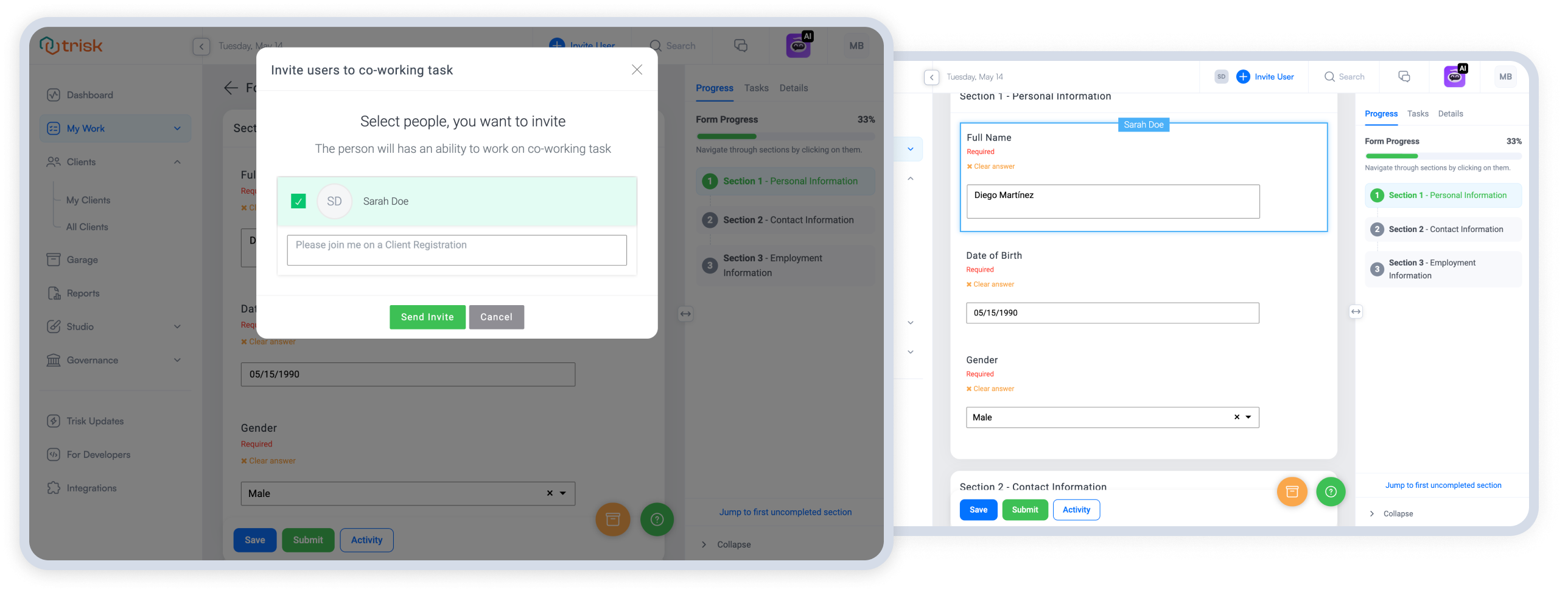

On the other hand, the organization’s people can seamlessly engage with the client team and jump into the project at any point in time. For instance, when the client struggles with task completion, they can invite a representative to a co-working mode to collaboratively solve the issue and receive hands-on guidance from the team.

Upon the client’s submission of the information, the platform initiates a review process that triggers email and dashboard communications to the responsible parties. Your team alerted to jump in when needed instead of constantly checking on the status of the client-related project portion.

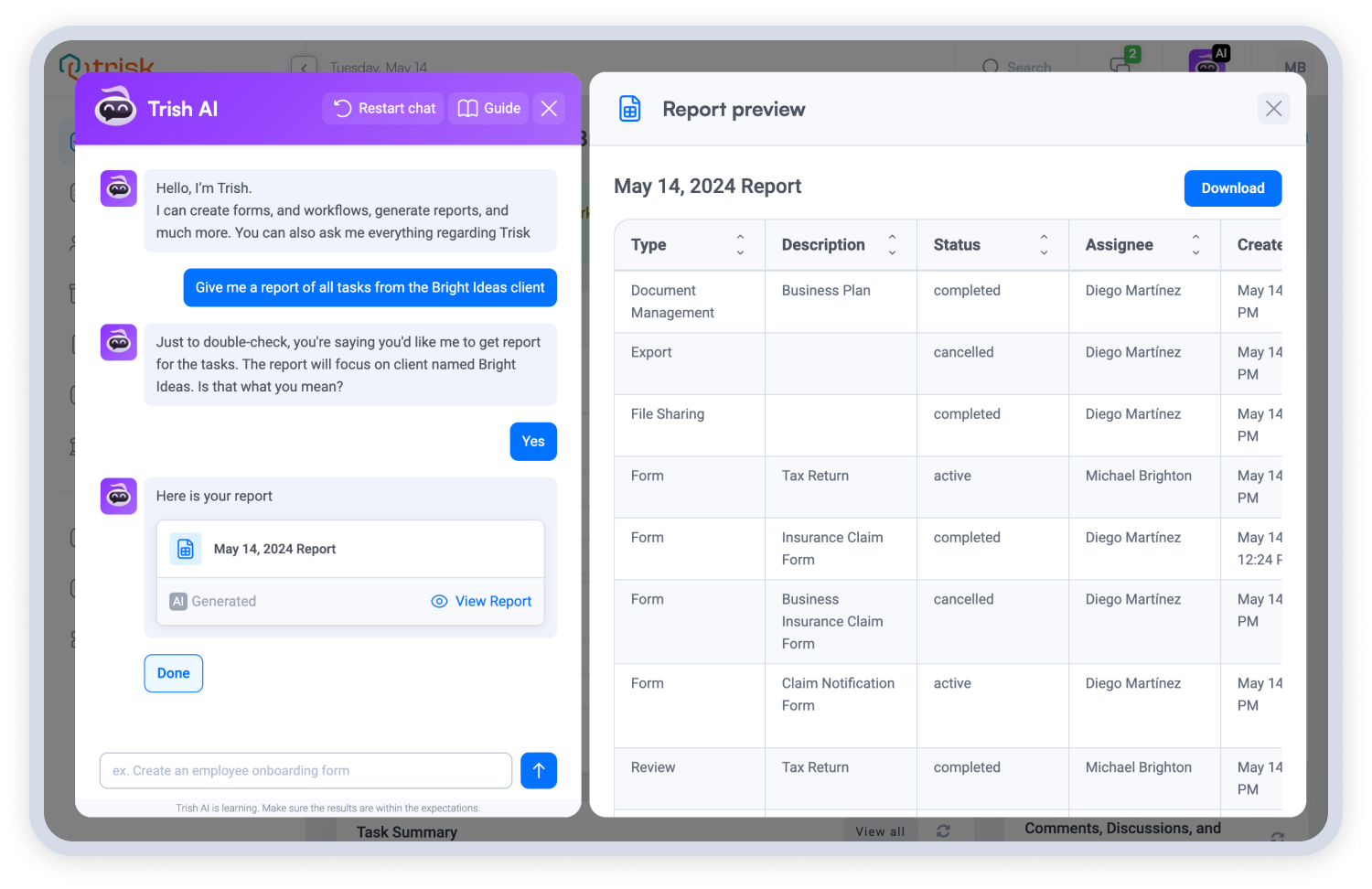

With comprehensive AI models uniquely crafted for the financial domain, you have a chance to further free up human time by allowing AI to privately analyze and assess the information input from any user with an output in the form of highlights and drafted comments for analysts to review and submit. Instead of spending countless hours reviewing client’s information over and over again, with each new client, you can set the organization’s rules and train your dedicated AI model to do the work for you in a matter of minutes, saving you up to 80% of the time spent with traditional effort. AI analyses provide you with

Anomalies detection

Errors or lack of data

Projections on the project success

Patterns recognition

Tailored service offerings

Finding hidden business opportunities

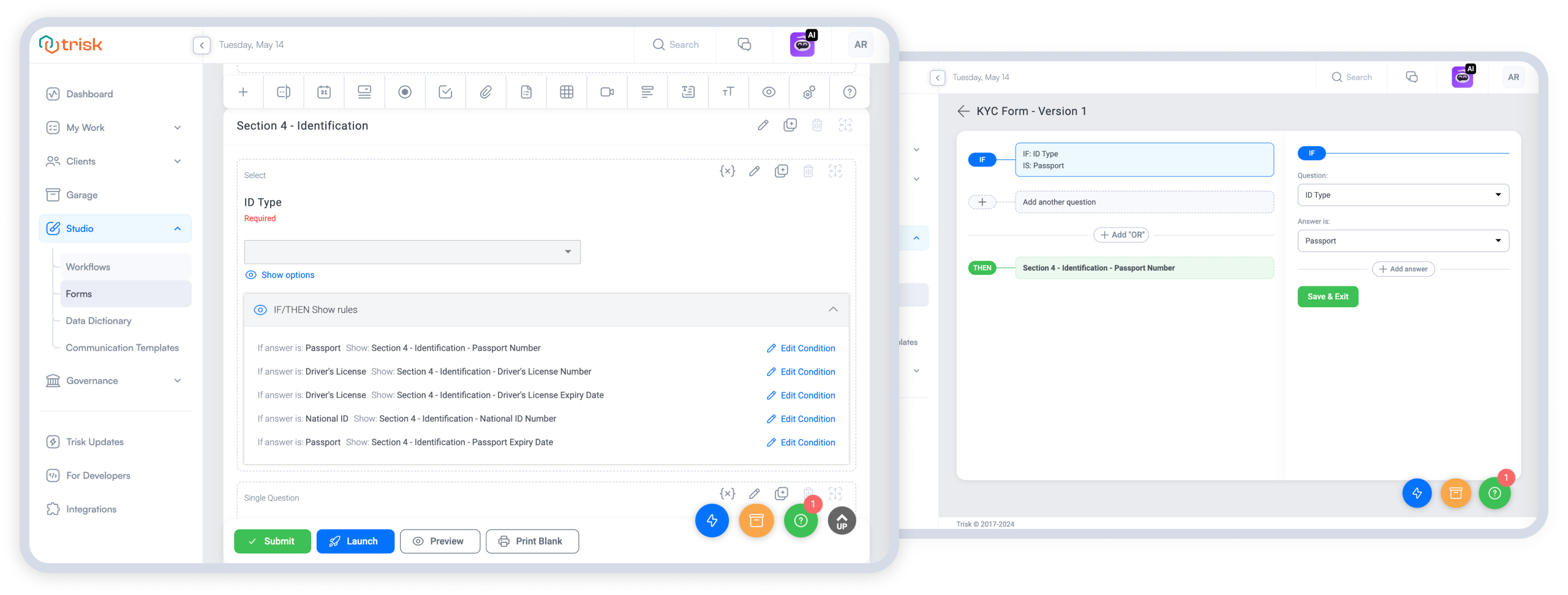

If your organization has multiple offerings, Trisk is a good place to automate them in the most convenient and friendly way from the client’s perspective. We all know that upselling a client from the very initial touch isn’t a successful tactic, but with IF/THEN logic, you can construct a decision tree in the form that controls additional workflows to be launched to the sales department, client team, or other responsible parties. As you get more familiar with a unique client situation or business case, Trisk allows you to specifically tailor the offering of extra services and get you closer to a green light from the client decision makers effortlessly.

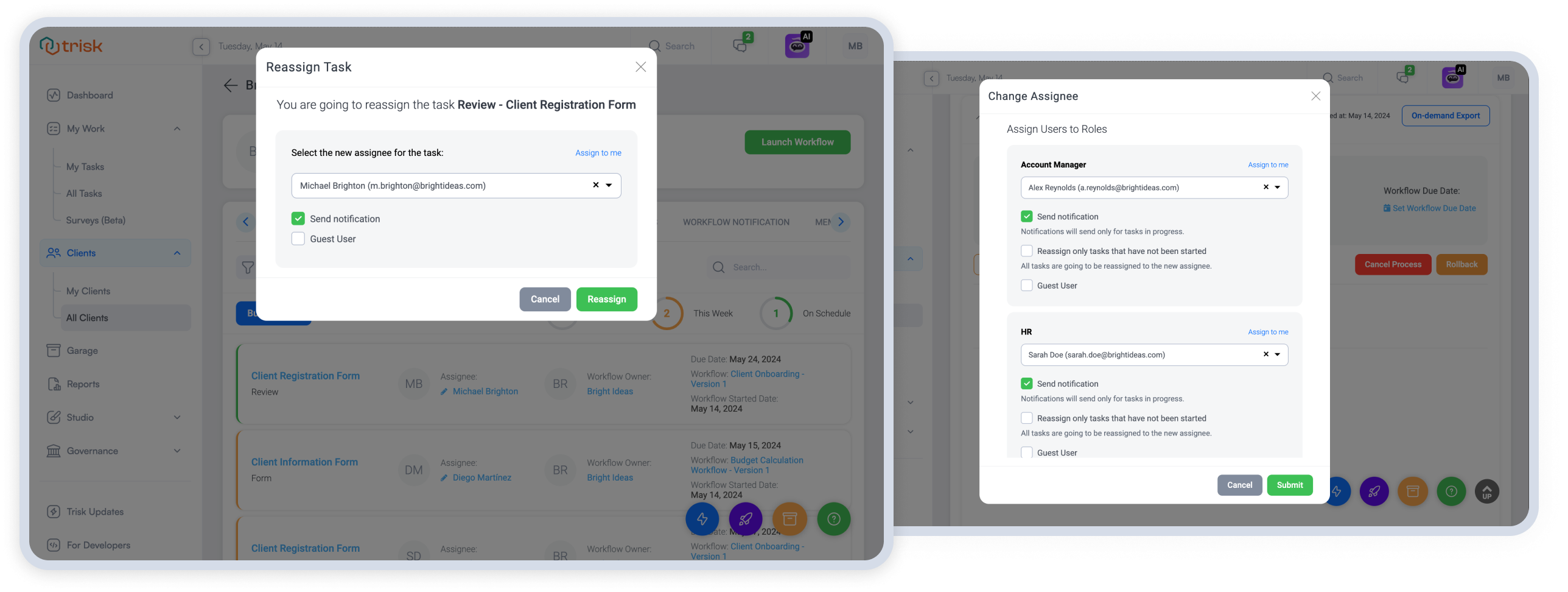

Everyone tends to make mistakes, and it is a nightmare to apply a fix when the project is handled manually, over emails and Excel spreadsheets. Trisk is flexible and allows you to rollback the project to the detected issue, correct it, submit, and let the platform handle the rest of the automation. If the correction leads to the need for additional tasks to be launched, it will be handled automatically, and the rest of the already completed activities will remain intact. Want to change the assignment because of PTO or the absence of the current responsible person? With a click of a mouse, the platform re-routes all (or part) of the tasks to the new assignee, updates the dashboard, and tracks the activity for the sake of compliance.

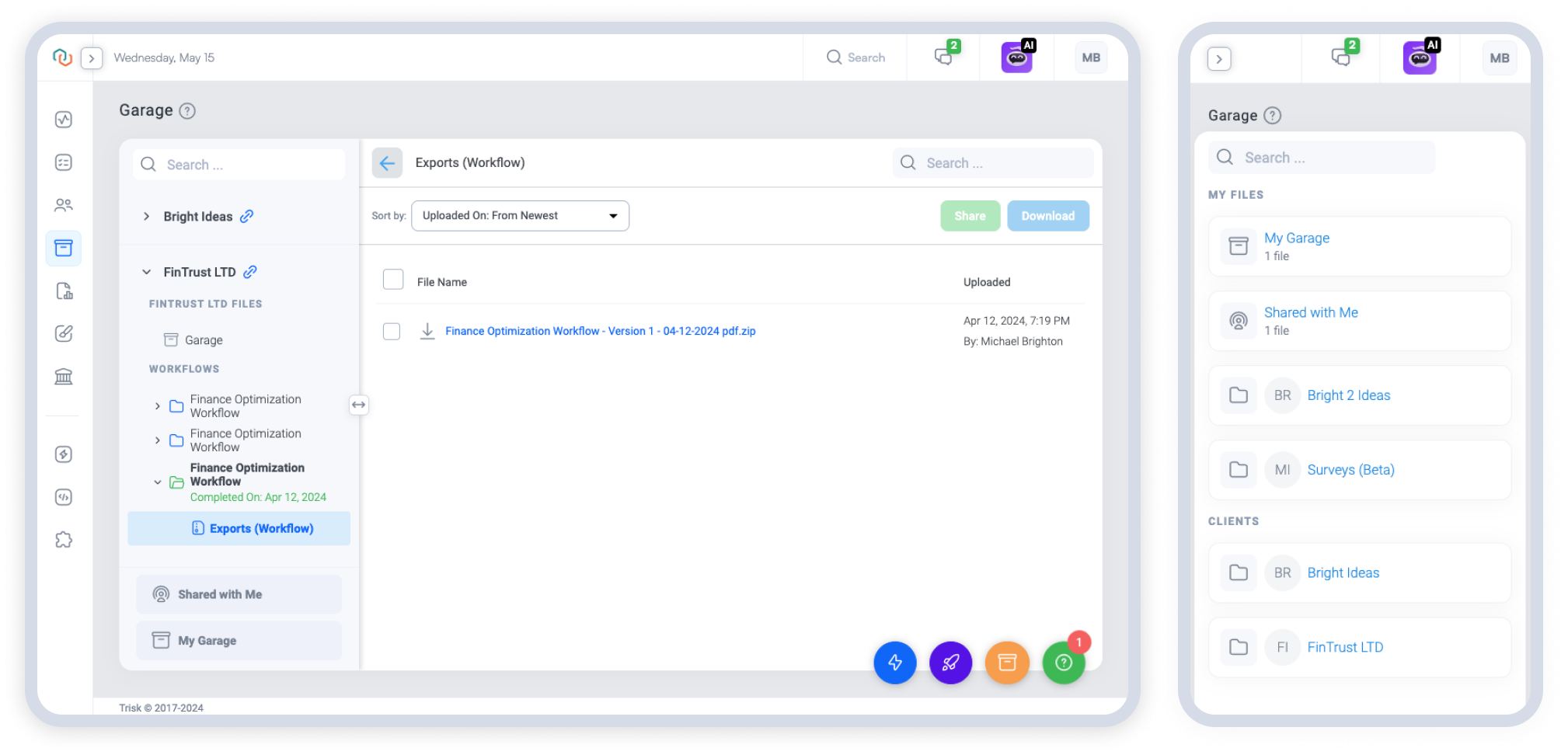

As the project advances and produces output, all the responses, attachments, findings, and the rest of the information is proactively and securely stored in the client’s Garage, making the information accessible and easy to find. Speaking of accessibility, while Excel spreadsheets are hard to manage from mobile devices, Trisk is available from any device and location powered by the robust authentication system, ensuring only the right people get access to the information.

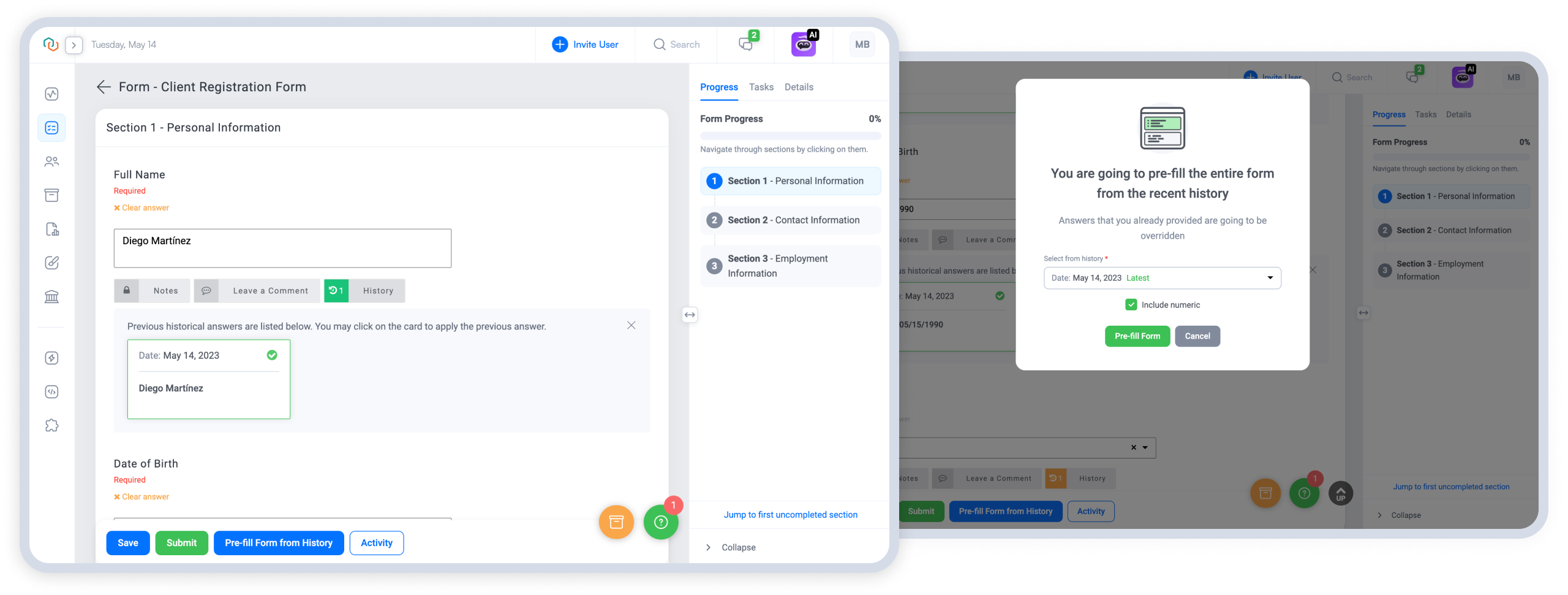

The platform keeps track of historical records and enables users to reuse information in future projects by simply predefining the answers from the history, uniquely combined from the workflow template and the actual client situation from the past. This is a very powerful approach to memorizing the uniqueness of the client use case and carrying the specifics forward across all projects.

This comprehensive yet simple onboarding process is just the beginning of the thriving client’s and company’s journey to success and strong relationships in the future. The very first experience defines the outcome of the engagement and either establishes trust or falls apart.

For C-suite professionals in the financial sector, adopting Trisk is a strategic decision to enhance operational efficiency, improve client engagement, and drive substantial revenue growth. It addresses the immediate challenges of client onboarding and positions financial organizations to thrive in an increasingly competitive marketplace. By leveraging Trisk, leaders ensure their organizations remain agile, client-centric, and capable of sustained growth, all while managing resources effectively in a challenging talent landscape. In summary, Trisk is not just a tool for improving operations; it's a strategic asset for securing a future-proof advantage in the financial services industry.

Explore our flexible plans with per-active user model, all-in-one features, AI

assistance, and 30-day free trial with no credit card required