A mid-sized insurance brokerage offering both commercial and personal lines. With thousands of clients and multiple carriers, the firm faced increasing pressure to modernize its processes while maintaining compliance and client satisfaction.

faster policy binding

with streamlined intake and automation.

hours saved per employee per month

freeing staff for higher-value work.

audit readiness

through structured approvals and a complete audit trail.

Delays in policy binding due to incomplete or inconsistent submissions.

Compliance headaches during audits, with records scattered across different tools.

Heavy administrative burden, with staff spending hours on reminders instead of advising clients.

Poor client experience, as customers were repeatedly asked for the same information.

The team knew they needed a smarter way to handle intake, renewals, and compliance - without adding more systems to manage.

The brokerage implemented Trisk to centralize and automate its client workflows.

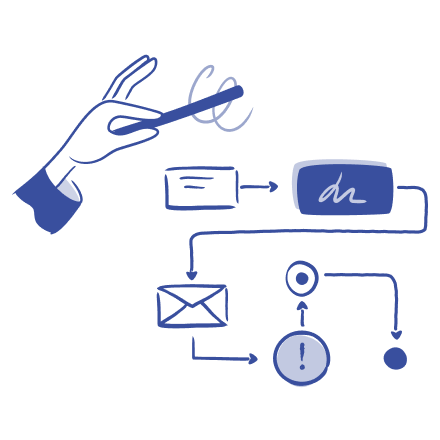

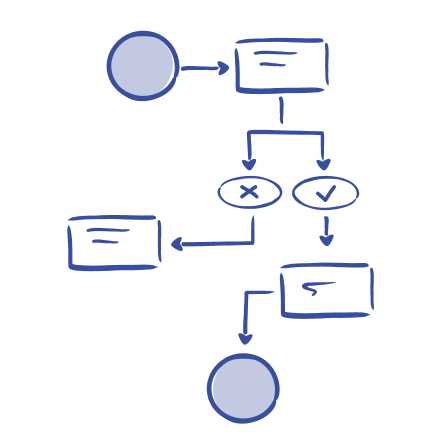

Within weeks, the team redesigned their intake and compliance process using:

that validated information at the source and routed submissions automatically

for renewals, claims, and compliance checks - complete with built-in reminders and escalation rules.

in one platform, eliminating back-and-forth emails.

with clear approvals and version history, easing compliance pressure.

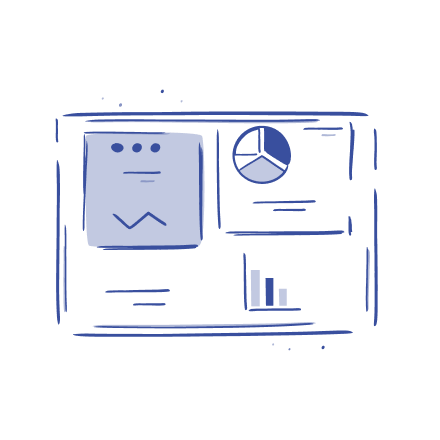

giving managers full visibility into bottlenecks and progress.

By gradually layering Trisk into its workflows, the firm avoided disruption while unlocking compounding efficiencies

With Trisk in place, the brokerage quickly realized measurable improvements:

with streamlined intake and automation.

freeing staff for higher-value work.

through structured approvals and a complete audit trail.

with smoother renewals and fewer requests for duplicate information.

Join other brokerages using Trisk to deliver faster service, reduce risk, and keep clients happy

“It's easy to use. It's all there. We're not near using the full potential of Trisk and it's already transforming how we do things. We're able to reduce the burden (on school staff), allow them the ability to get out their information to all the necessary parties such as first responders, fire, police, etc. and we're able to do it quickly.”

Bob Klausmeyer

Education Safety Coordinator